Working Without Firefly is Like Eating Soup With a Knife or Fork

Imagine you’re seated in a fine restaurant and the waiter brings to you a big bowl of delicious soup – along with a knife and a fork.

“How am I supposed to eat with either of these?” you ask.

What you want is a wide, deep soup spoon that will get the broth, noodles and meat to your mouth with each dip into the bowl. Trying to eat soup with a knife or fork will take tons of extra effort, and is extremely difficult to do.

“This is ridiculous!” you think.

And you are right. But there is an analogy to being an insurance agent here, too.

The bowl of soup is like your prospects. If you can get them out of the bowl, they become your customers.

The number of direct insurance carrier appointments that you have equates to what silverware you can use to get those prospects out of the bowl.

Being an insurance agent with only one carrier is like eating soup with a knife.

This is the life of the captive agent. You have one company. They might have good people and fantastic claims service. But they also have their target market that they are competitively priced for – and unfortunately, that market is small.

It’s like you’ve been given a knife to get soup out of that bowl. Maybe you can balance a chunk of chicken on the wide part of the knife to bring it to your mouth. Maybe you dip the knife into the bowl and rush it to your lips so you can lick the broth from it before it drips away.

Yes, you can get a bit of that soup out of the bowl. But it’s very hard work. It’s not satisfying. You get little tastes of goodness – but you are always working at it and you are always hungry. 😞

When you’re honest with yourself, you are tired of trying to eat your soup this way. You look around and see others who seem to be eating better than you are with less effort.

If only you had a spoon!

Being an independent insurance agent with only 4 or 5 direct insurance carrier appointments is like eating soup with a fork.

Yes, you are better off than the captive agent. But you still have a frustrating job ahead of you.

Here’s why:

Each carrier you have is like a tine on a fork. They make it easier for you to wrap up a few noodles, or to spear a pea. But you still can’t get at the broth, and much of that delicious soup is still going to slip off of the fork stay in that bowl in spite of your best efforts.

And you work hard at it, with your fork!

You know that if you had more direct insurance carrier appointments, your fork would have more tines and you could get even more soup out. But every carrier has production requirements – so you can’t add more carriers without risking losing the ones you already have.

Losing a carrier and having to move your existing customers to a new one doesn’t satisfy your appetite or help you grow at all. You are spinning your wheels. And you know that you can never move everyone from the old carrier, so you’re going to lose customers for sure. You’d be much better off not losing the carrier in the first place.

And brokering policies? You know that’s not really the solution. It means you do extra work for less commission.

Yes, you could be worse off, but you’re still frustrated, and hungry. This isn’t what success feels like.

Like the captive insurance agent, you also wish you had a spoon.

Being an independent agent who works with Firefly is like eating soup with a spoon.

With Firefly, you have more carriers than almost anyone. Better yet:

- You have direct appointments with every single insurance carrier.

- You get a very high commission split on every one of them.

- And you have one small production requirement with Firefly that lets you to sell each carrier without any per-carrier production requirements.

This means you win more customers because you can give them coverage they need at a great rate with the insurance company that fits them best.

This relief from per-carrier production requirements lets you write more personal and commercial insurance than anyone you know.

You don’t have to worry if you write only a small number of customers with one carrier, because Firefly keeps all of them happy for you. You don’t lose carriers, which means you can spend more of your time growing your insurance agency instead of spinning your wheels.

With all of the direct insurance carrier appointments you have, you can get more soup out of that bowl than anyone around. You turn a higher percentage of prospects into customers than ever before. You are meeting your goals. You’re not hungry and frustrated anymore.

In fact, you realize that becoming an independent insurance agent with Firefly is like being given a ladle instead of just a spoon!

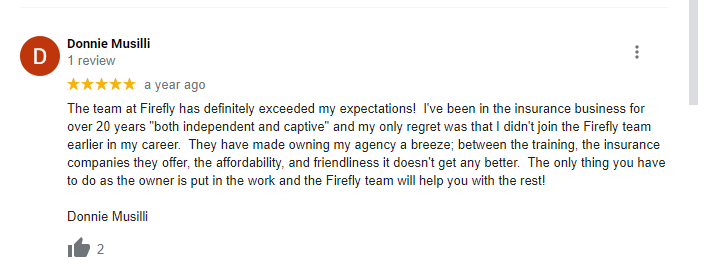

This agent explains his experience getting direct insurance carrier appointments with Firefly.

So, if you are a captive insurance agent, trade your knife in for a spoon – not a fork.

If you are already an independent insurance agent and feel like you have a fork – you can keep it and get the spoon as you get directly appointed with great insurance carriers through Firefly.

What are you waiting for? If you’re like Donnie you’ll wish you made the trade-in sooner!

For more details about getting direct insurance carrier appointments as an independent agent with Firefly, download our free ebook.